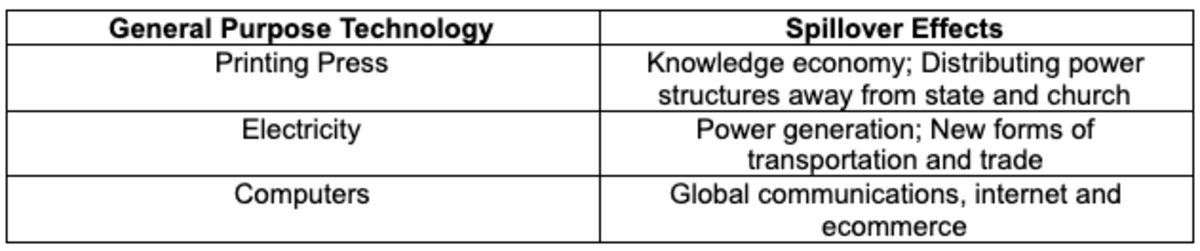

Some inventions are so profound that their second order effects reshape the very structures of societies.Â

The term general purpose technologies (GPTs) is used to describe innovations like electricity, the steam engine and the computer. The paradigm shifts made possible by these inventions are often not initially understood, and can take decades to reach mass adoption. But once the genie is out of the bottle, there is no going back to a world without them. Electricity was invented in the 1870s, but electric motors were not adopted in factories until 30 years later. GPTs can also become the bases for new innovations, and their spillover effects can redesign entire economic and social systems.

Bitcoin is one such general purpose technology. Now in its second decade, it has evolved from cypherpunk roots to become an emergent monetary asset. As a digital free market money with a predetermined supply, the invention of bitcoin will have lasting impacts beyond our time.Â

The first users of the printing press could not immediately envision how a free press would rearchitect the nature of society. Yet the freedom of information reshaped the power structures of Europe, and distributed power away from the hands of religious leaders and royalty. Just like the printing press denationalized the states monopoly on information, Bitcoin denationalizes the state’s monopoly on money. While the future is difficult to predict in micro events, we can study Bitcoin’s design to identify macro themes that are likely to emerge from its adoption.

Many of the trends mentioned here were seeded by prior events. Bitcoin provides an opt-out at the right place and the right time. In practicality, the timeline of these themes will overlap, with multiple forces of change working together. Collectively, they will result in second- and third-order effects that will broadly represent a future of digitization, decentralization and deflation.

The Digitization Of Money

Money was already on its way to digitization, when along came bitcoin. Digitization will spur the following broad changes in our societies:

- Cashlessness

- A new age of peer-to-peer commerce

- Fractional asset ownership

- Banking more people with fewer bankers

A Cashless Society

We’ve been migrating away from physical cash for the last two decades, but until recently, even the digital forms of money (such as electronic money transfers) had to be settled by offline entities, using legacy banking agreements. This changed with the invention of Bitcoin, and will become prominent in the 2020s.Â

Bitcoin has made it possible to have a currency that is both issued and settled online. The ability to use blockchain technology to issue and settle money has set off a race for public and private digital monies, which will expedite our move to a cashless society. By 2025, the International Monetary Fund (IMF) and the World Bank will be capable of facilitating central bank digital currency (CBDC) transactions, and countries will begin phasing out physical cash and coins.

The 2020s will also coincide with the coming of age for Gen Z, whose members will have grown up their entire lives knowing about the existence of Bitcoin. The presence of cryptocurrencies to Gen Z will be similar to the presence of the internet for Millennials — the technology was already here when they grew up. Globally, Gen Z is already the most populous generation, representing 32 percent of the global population. And money to this generation is digitally native.Â

The adoption of cashless societies will differ by regions and by incentives. Autocratic countries will want to mandate digital currencies as this empowers their surveillance capabilities. Citizens of developing countries will see digital money as an opportunity to leapfrog their current financial infrastructure. In the 2000s, countries like Nigeria bypassed the need to build a network of bank branches and skipped straight to mobile payments. We may see history repeating itself in the next decade.

Tokenized Assets, Fractional Ownership And A New Age Of Peer-To-Peer Commerce

Money isn’t the only asset that can be digitized on a blockchain. Eventually, other assets like real estate will also be digitized. For most of human history, people owned properties and traded in decentralized marketplaces. The rise of tokenized assets may return us to a digital version of the barter system. The ability to exchange value on a peer-to-peer basis will re-architect how we see trade.Â

The sharing economy of the 2010s enabled us to share temporary use of assets like homes and cars. The next marketplaces will enable an ownership economy, where assets can be co-owned and traded in a digital form.Â

A byproduct of asset tokenization will be the rise of fractional ownership, which will become the basis for entirely new business models. In particular, this will lower the barriers to investing, unleashing a new sharing economy and reframing our views of whole asset ownership. Stock splits will become a thing of the past, as users will be able to trade in fractions without worrying about a whole share of a business. One potential business model may be to provide services in exchange for tokenized ownership, rather than being paid for by a local currency.Â

The value accrual in the early 2000s sharing economy were centralized trusted parties who facilitated transactions, but Web 3.0 will result in new decentralized marketplaces. These new marketplaces will enable the exchange of value much like social media enabled the exchange of information. This theme will follow the macro pattern of digitization and decentralization.Â

Banking More People With Fewer Bankers

Instagram did to Kodak what Bitcoin will do to banking products. Web 2.0 made it possible to share digital photos, and Web 3.0 will make it possible to freely store and exchange digital money.Â

As an open-source financial asset, Bitcoin will re-architect the walls of our monetary systems. The 20th century monetary system was architected so that central banks had current account relationships with commercial banks, and commercial banks had relationships with end consumers. In this economic model, central banks acted as wholesale creators of money, and commercial banks bore the costs and profits of storing and distributing money. Bitcoin changes this monetary architecture. The beginning of the 21st century modernized the user interface of money with websites and mobile apps, but kept in place the institutional structures of the pre-digital era. Bitcoin changes this structure, first by digitizing money, and then also by replacing the need for local central banks.Â

One of the byproducts of Bitcoin adoption is that nation states will also roll out their own blockchain-based digital currencies, making it possible for governments to directly transact with citizens. If COVID-19 were to repeat as COVID-29, governments would be able to airdrop direct relief to citizens without needing banks. The proliferation of digital currencies will erode the traditional payments and foreign currency exchange revenue for banks.Â

Bitcoin will also be an alternative to traditional savings products like savings accounts and GIC-approved investments, and store-of-value products like gold (if bitcoin were to reach a total valuation of $8 trillion, it would be worth the same as the gold market) and fiat-denominated bonds (which is a $128 trillion market). In particular, by offering an alternative to government-issued bonds, bitcoin will not only represent an alternative to banking products, but also change the relationship between money and the nation state.Â

Decentralization And The Separation Of Money And State

This is where Bitcoin’s Austrian Economic roots will become more prominent. As early as 2012, the European Central Bank credited Bitcoin’s economic philosophies to be inspired by Austrian Economist and Nobel Prize winner Friedrich Hayek. Hayek was a leading proponent of the denationalization of money, and a promoter of free competition between different types of money. If the nation state is the epitome of central authorities, Bitcoin will be the flag bearer for decentralization. The themes that play out with decentralization will be as follows:

- Unbundling money from offline borders

- Constraining the power of governments

- The rise of Decentralized Autonomous Organizations (DAOs)

Unbundling Money From Offline Borders

Digital money by nature is transnational. Under a physical money world, borders can help protect against cross-currency flight risks. This changes when currencies are digitized, as their demand will come from their network effects rather than local offline laws. Â

Digitization will also unleash a new wave of currency competition by unbundling “the functions served by money (store of value, medium of exchange and unit of account).� There is a potential future where bitcoin fulfills the store-of-value function of money, while the price of items (unit-of-account function) could still be quoted in local terms.

As switching costs of currencies get eroded, citizens of underdeveloped countries will see benefits of switching out of weak currencies for stronger currencies like the dollar, euro or bitcoin. The themes of digital dollarization and bitcoinization will eliminate local government monopolies on money, which will constrain the fiscal power of these governments in the longer term.

Constraining The Power Of Governments

Defund the military? This might be one of the long-term byproducts of the separation of money and state. One of Bitcoin’s second order effects will be privacy currencies which are harder to tax. Another one of Bitcoin’s second order effects will be to erode the value proposition for government bonds, which will reduce a key government funding mechanism. Together, these forces will constrain the power of the nation state.Â

Governments will try to curb the use of private money, and privacy will be one of the biggest social debates around Bitcoin regulation. Even if Bitcoin is never fully private, Bitcoin has opened up the path for anonymous digital stores of value, which will challenge the business model of the offshore banking industry and tax havens.Â

Here is where Bitcoin’s libertarian influence will become more prominent. Taking away a government’s ability to print money will reduce the size of government spending programs. Many government social programs will need to be reprioritized, and governments will have to decide whether military spending should remain the largest portion of their budgets.Â

The popularity of decentralized digital currencies will bleed into online communities and social networks, giving rise to new types of economically-connected internet communities.Â

The Rise Of Decentralized Autonomous Organizations (DAOs)

Money will be a part of social networks in the future, and there will be economically-connected successors to what Facebook groups are today. Digital money will be used as an economic infrastructure to create new types of digital organizations where people don’t have to be co-located. These new decentralized organizations will reshape the very nature of firms, by programming ownership and governance rules on a blockchain.

The popularity of GoFundMe has already proven that the internet can be an effective tool for crowdfunding. Programmable money will combine digital money and smart contracts to create new types of firms which live natively on the internet. While earlier versions of crowdfunding focused on raising money, DAOs will enable a new type of digital co-ownership. Future versions of GoFundMe will be organizations that behave like digital cooperatives, which are funded and owned by the crowd. If people want to support a humanitarian cause, they will be able to pool together assets and spin up an organization with a transparent treasury and where funding disbursement rules are programmed as part of a digital constitution.Â

We may see money get bundled as part of social networks, with new incentive structures to reward contributors to the network. A for-profit DAO might be a collective where people pool together funds to co-own smart machines, and share the profits from their operation. There will be entire new sets of laws created around regulating such organizations, as they will operate on the internet and not in offline jurisdictions. Over the long-term horizon, a DAO with a large enough network effect may even compete with nation states for influence, which may create a form of digital states.

From An Inflationary To A Deflationary Society

Technology is inherently deflationary. During both the first and the second industrial revolutions, the world experienced deflation as increased technological outputs improved productivity, improving our purchasing power in the process. As we move into an age of technological abundance, we will once again see the return of deflation.

By nature, technological innovation should make things more efficient and cheaper, yet the price of goods and assets rises because our inflationary currencies lose value every year. This is where Bitcoin’s deflationary design will have lasting social changes to our economic behaviors:

- Changing our outlook on earnings and wages

- Changing our impulses toward debt and consumption

Changing Our Outlook On Earnings And Wages

The rise of inflationary money since the 1970s has benefited rich capital owners, while the labor class has had to work more hours to make ends meet. This is likely to have a dangerous tipping point, where currency debasement meets job automation. In these times, Bitcoin’s deflationary design will become more prevalent.

Bitcoin’s deflationary design will enable a world where savings aren’t automatically debased, and where people can take advantage of technological innovation. This may even have an impact on family structures by removing the need to have dual income households, which could have a longer-term impact on family structures.Â

In a deflationary society with a decreasing cost of living, we might see the end of the 20th century minimum wage debates. In an inflationary environment, governments have to enact new laws to increase minimum wages in order for workers to keep up with a rising cost of living. By contrast, when savings are denominated in a deflationary currency like bitcoin, they will go up in value, leading to a paradigm shift in how we view savings and consumption.

Changing Our Impulses Toward Debt And Consumption

Inflationary currencies promote debt and consumption by devaluing the cost of debt servicing, and by disincentivizing cash savings. When all money is digitized, we will have a much easier time spending it. Much like the internet made us addicted to information and screen times, the digitization of money will enable our worst impulsive spending habits. In an era of one-click purchases where drones provide real-time delivery, we will need monetary incentives to protect us from our impulses. Bitcoin’s deflationary design will become an important part of the saver’s toolkit.Â

In a world of digital tokens, people might put their savings in bitcoin, and keep a day-to-day spending account in a local currency. In this world, bitcoin might serve as a savings account and local currencies might serve as checking accounts. Switching out of bitcoin to an inflationary currency would be akin to liquidating a store of value, making us mindful of the opportunity costs for consumption.

The move to a deflationary society will also have social effects by changing how we think of finance, and how we think of instant gratification. By incentivizing delayed gratification, we might see the demise of “buy now, pay laterâ€� business models. We will even need to adjust our societal prosperity measures like GDP, so that a nation’s wealth is not measured by the amount of consumer and business spending. Â

Conclusion

The next decades will prove that bitcoin is more than a digital cash. For bitcoin to be adopted as a global general purpose technology, we will need to solve technological issues like rural internet accessibility, and thorny social issues like financial privacy. There are likely to be intensified debates around wealth concentration and the role of government oversight.Â

As with other general purpose technologies, the second order impacts of Bitcoin will play out over a period of several decades. The genie is now out of the bottle, and there’s no going back. We’ve started by digitizing commerce. Soon, Bitcoin will decentralize power structures, and eventually, rewire our time preferences for a world that embraces technological deflation.

This is a guest post by Ammar Naseer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post The Second Order Effects Of Bitcoin – Bitcoin Magazine appeared first on TechFans.