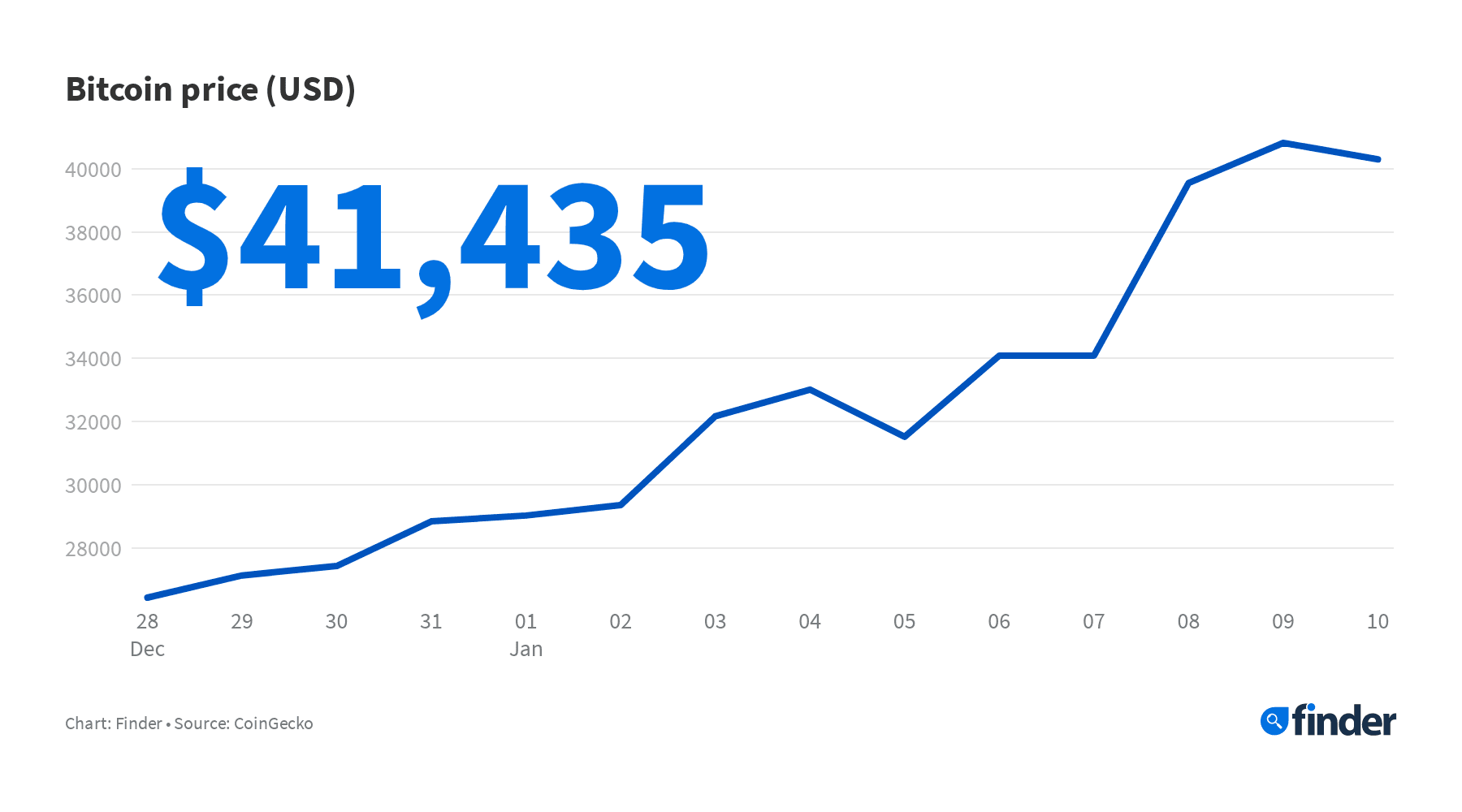

Since doubling in price in only 3 weeks Bitcoin is experiencing resistance above US$40,000 as whale activity increases before an 8% sell-off.

- Bitcoin sliding as low as US$35,476 with heavy volatility

- Bitcoin whales move US$500 million in Bitcoin, market drop follows

- Altcoin market largely down

Bitcoin is currently trading at around US$38,493 (AUD$49,861) well down on the day’s high of US$41,435 (AUD$53,672). Markets have traded in a negative range of 14.3% with Bitcoin’s low recorded only hours ago at US$35,476 before a v-shaped recovery to its current price.

The leading payments processing altcoins are all down for the third day in a row. Ripple’s XRP, which is soon to enter into a trading halt on US markets, is down just under 5% and Stellar Lumens are leading the rout having lost shy of 12% on the day.

The resistance that Bitcoin has shown at around the US$40-$42,000 mark is the first sign of a slowing bull run that began picking up momentum in early September 2020. The resistance and heavy volatility happened at the same time as large amounts of Bitcoin totalling over US$500 million were transferred between unidentified wallets, preceding an 8% contraction in Bitcoin’s price.

Bitcoin whales move US$500 million after price tops US$40,000

An unidentified trader transferred 4,892 Bitcoin worth US$196 million just as BTC hit US$40,000 according to data released by Whale Alert. That transaction was followed by another two large transactions of 4,306 Bitcoin and 3,400 Bitcoin, only nine hours later.

It was at that time on Friday 8 January that the Bitcoin spot rate dropped significantly from around US$40,000 to US$36,735 over the next 11 hours. It’s not clear whether the considerable transaction volume from whales was what spooked the market.

When asked about whether Bitcoin could enter another price decline similar to what followed the 2017 bull run, or more recently the crypto sell-off in the wake of COVID-19 lockdowns, the director of business development for smart chain platform Komodo, Jason Brown said that “such a scenario is unlikely”, according to reporting from CoinTelegraph.

However, Brown said one major market risk is that the supply of digital assets has become “even more centralized”, meaning that it could be easier for a sell-off to be triggered by a large dump of digital assets from a major financial institution or Bitcoin whale.

In support of that statement, cryptocurrency exchange Kraken released a yearly market recap with information suggesting that the largest Bitcoin wallets had grown considerably during Bitcoin’s most recent surge since September 2020.

Bank of America note to investors

Bitcoin’s performance is more than double that of any previous “bubble”. Source: Bloomberg

Going against JP Morgan’s most recent notes to investors which showed capital outflows from gold in favour of capital inflows to Grayscale Bitcoin Trust (GBTC), a note to investors from Bank of America sounded greater caution with its projection for both digital assets and broader financial markets according to reporting from Reuters.

BofA, which has Warren Buffett’s Berkshire Hathaway as a majority stakeholder, wrote to “sell the vaccine: frothy prices, greedy positioning, inflationary and desperate policymakers, peaky China and consumer all ultimately (a) toxic brew in 2021”, according to BofA’s chief investment strategist Michael Hartnett.

Maintaining the line that Bitcoin’s rise could be a bubble, Hartnett said that the recent Bitcoin bull run “blows the doors off prior bubbles”, which includes the dotcom boom in the late 90s and commodities such as oil and gold during the inflationary period of the mid-1970s.

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, see how to keep your crypto safe with our end to end guide to cryptocurrency security and dive deeper with our simple guide to DeFi.

Disclosure: The author may own a range of cryptocurrencies at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.

Picture: Finder

The post Bitcoin price getting sluggish above $40,000 appeared first on TechFans.